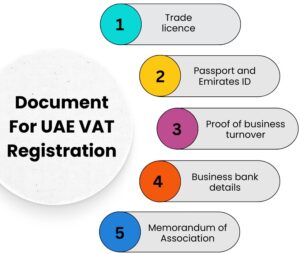

VAT registration is the process by which a business enrolls with the tax authority to collect and remit Value Added Tax on taxable supplies. It ensures compliance with legal requirements, allows input tax credit claims, builds business credibility, and is mandatory once turnover crosses the prescribed threshold.

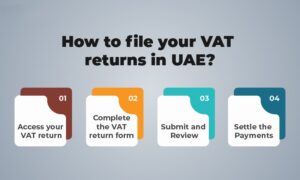

VAT filing is the process where registered businesses in the UAE submit periodic returns to the Federal Tax Authority (FTA), detailing output tax collected and input tax paid. It ensures compliance, accurate reporting of transactions, and payment of net VAT liability, usually on a quarterly or monthly basis.

A VAT audit is a review conducted by the UAE Federal Tax Authority (FTA) to verify a business’s compliance with VAT laws. It examines records, returns, and invoices to ensure accuracy of tax reporting. Proper documentation and timely compliance help businesses avoid penalties and maintain regulatory trust.

VAT deregistration is the process by which a business cancels its VAT registration with the UAE Federal Tax Authority (FTA). It is applicable when turnover falls below the mandatory threshold, the business ceases operations, or meets other FTA criteria. Deregistration ensures compliance and prevents unnecessary VAT obligations.

Our Record Speaks For Itself

IGSK Corporate Tax Advisors has expert team specializes in Corporate Tax, VAT, Accounting, Bookkeeping, Auditing, Compliance & Business Advisory services, delivering tailored financial solutions designed to empower businesses across the UAE. With us, you gain a partner committed to your success at every stage of your journey.

A business strategy is the means by which it sets out to achieve desired ends. You have ideas, goals, and dreams. We have a culturally diverse, forward thinking team looking for talent like you.

Its an approach that the bring to gather the best financial planning top and the best investment management

IGSK Corporate Tax Advisors has supported me with my PRO services, and everything was completed on time. Their attention to detail and quick response made the process very easy for me.

Very professional and supportive team! They resolved our issue quickly and kept us updated throughout the whole process. A special mention to Stella Thomas – her professionalism, communication, and dedication truly stood out. If it were possible, she definitely deserves more than 5 stars! Highly recommend their services.

Sheik Zayed ,Dubai, U.A.E.

Bandra West, Mumbai, INDIA

+9710000000000

© 2025 IGSK Corporate Tax Advisors. All Rights Reserved.