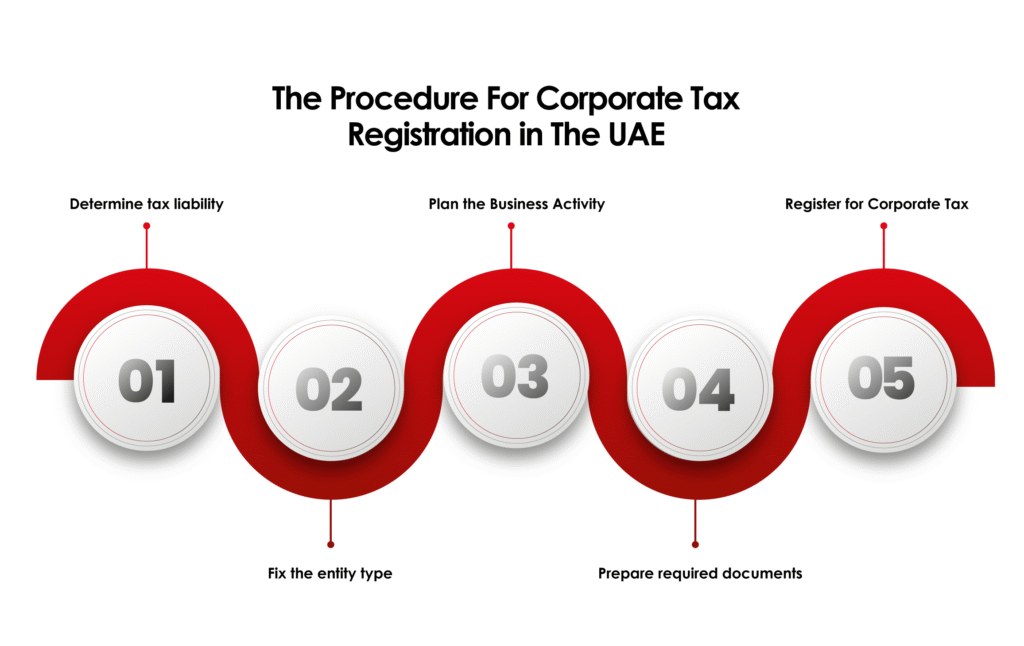

All UAE businesses must register for Corporate Tax to avoid hefty fines. With expert guidance, the process is seamless, ensuring compliance well before deadlines. If your business ceases operations, you must also de-register within three months to stay compliant.

Corporate tax filing in UAE requires businesses to register with the FTA, maintain proper financial records, and submit annual tax returns online. Companies must calculate taxable income, pay due tax, and comply with deadlines to avoid penalties and fines.

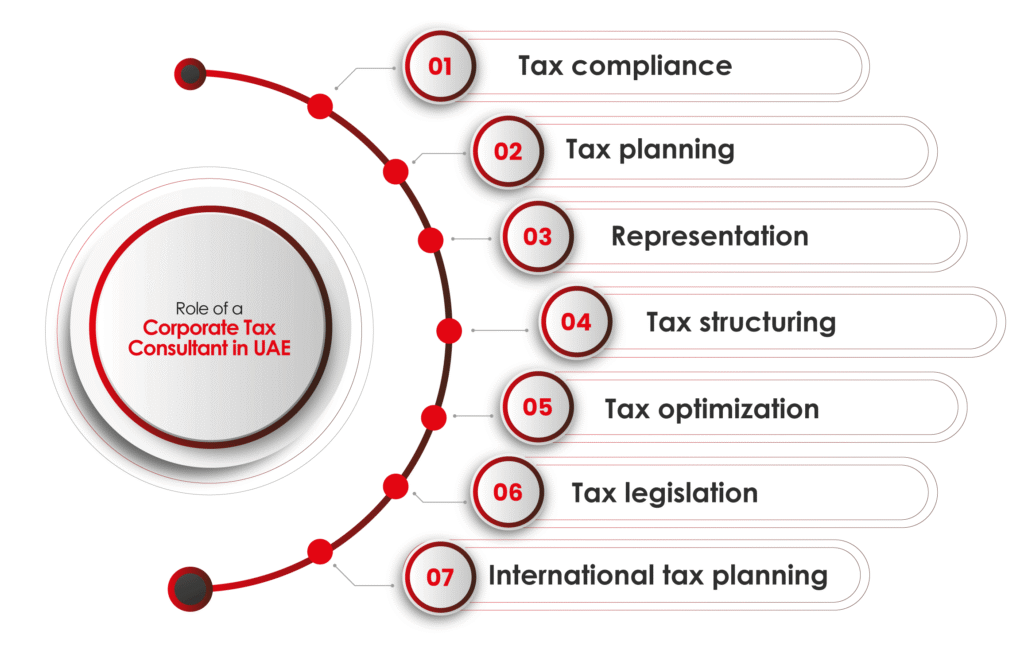

Corporate tax advisory services help businesses navigate UAE’s tax laws by providing expert guidance on registration, tax planning, compliance, and return filing. Advisors ensure accurate tax calculation, optimize deductions, minimize risks, and assist with FTA audits, enabling companies to remain compliant while improving financial efficiency and long-term profitability.

Corporate tax deregistration in UAE is required when a business ceases operations, liquidates, or no longer falls under corporate tax obligations. Companies must apply through the FTA portal, clear outstanding tax liabilities, and submit final returns to receive official deregistration approval, ensuring compliance and avoiding future penalties.

Our Record Speaks For Itself

IGSK Corporate Tax Advisors has expert team specializes in Corporate Tax, VAT, Accounting, Bookkeeping, Auditing, Compliance & Business Advisory services, delivering tailored financial solutions designed to empower businesses across the UAE. With us, you gain a partner committed to your success at every stage of your journey.

A business strategy is the means by which it sets out to achieve desired ends. You have ideas, goals, and dreams. We have a culturally diverse, forward thinking team looking for talent like you.

Its an approach that the bring to gather the best financial planning top and the best investment management

IGSK Corporate Tax Advisors has supported me with my PRO services, and everything was completed on time. Their attention to detail and quick response made the process very easy for me.

Very professional and supportive team! They resolved our issue quickly and kept us updated throughout the whole process. A special mention to Stella Thomas – her professionalism, communication, and dedication truly stood out. If it were possible, she definitely deserves more than 5 stars! Highly recommend their services.

Sheik Zayed ,Dubai, U.A.E.

Bandra West, Mumbai, INDIA

+9710000000000

© 2025 IGSK Corporate Tax Advisors. All Rights Reserved.